How to fill IRS Form 8300, your way.

The steps below are convenient starting point for most businesses. You can customize anything to fit your unique needs.

Fill IRS Form 8300 with your data

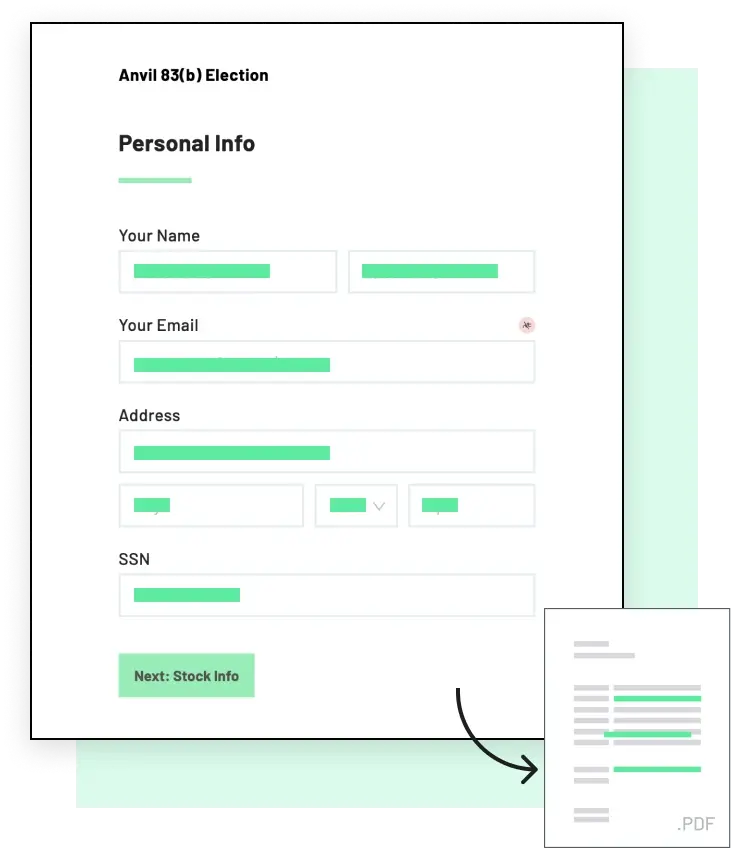

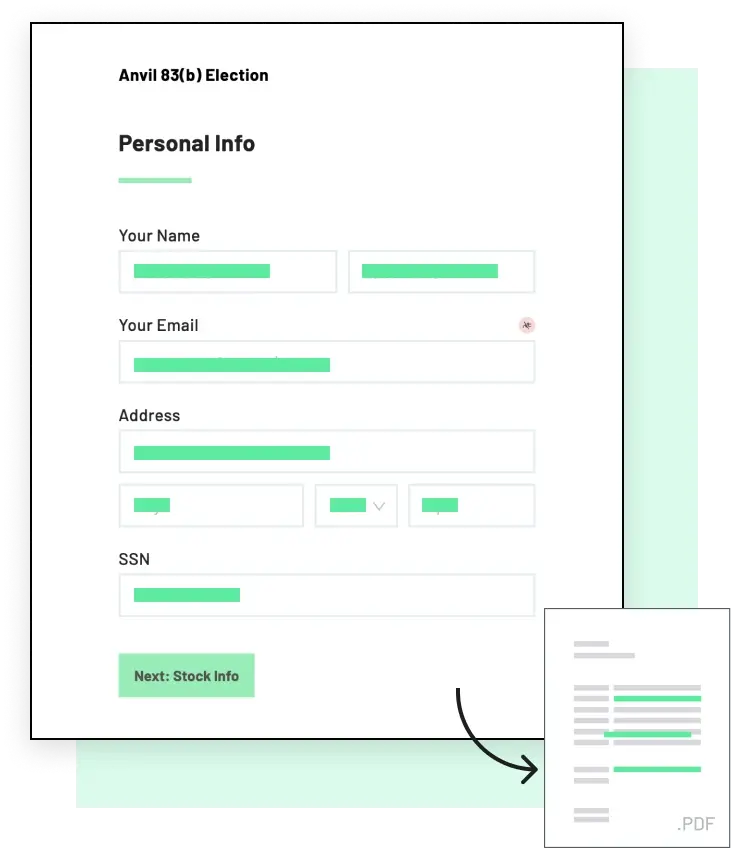

Need to collect data first? Create a Webform.

Updated Jan 13, 2025

The Form 8300, Report of Cash Payments Over $10,000 in a Trade or Business, provides valuable information to the IRS and the Financial Crimes Enforcement Network (FinCEN) in their efforts to combat money laundering. A "person" who must file Form 8300 includes individuals, companies, corporations, partnerships, associations, and trusts or estates. Electronic filiing mandate changes begin Jan 1, 2024. Please see the IRS Form 8300 page for more information.

The steps below are convenient starting point for most businesses. You can customize anything to fit your unique needs.

Our pre-built Workflows save teams 100s of hours of manual work. Tell us how you're trying to use this IRS Form 8300 form into your product.

Explore your use caseExplore more business PDF forms below or see all business templates here.